The Secret Decoder Ring for Your Data Puzzle

Financial Master Data (Part 1)

Imagine someone dumps a 1,000-piece puzzle on a table, throws the box away, and tells you you’re fired if you can’t solve the puzzle ASAP. Not only do you have to conquer that challenge, but a dozen people are watching you work on it, telling you what part of the puzzle they think you should work on first. These people don’t know what the finished puzzle looks like either, but you have to take their opinions seriously, since some of them are your bosses.

That's what the life of a data manager feels like; it doesn't matter how much technical experience you have if you don’t know what the data should look like when it’s all put together.

What if I told you there’s a secret decoder ring that connects all the pieces of your company’s data puzzle? What if I said it’s free, easy to implement, and removes most of the friction that slows your company’s decision-making?

If that doesn’t grab your attention, then maybe this warning will: most analytic solutions get this connection wrong, and people’s efforts to connect data with business decisions usually make the problem worse. Writing more code and reports without this solution makes your data platform more fragile and less efficient.

The Link

I met the ultimate puzzle master in Broadcom’s Chief Information Officer, Ken Venner. Ken wrote this phrase on the whiteboard in my office for me to see every day: “Operational action = financial effect.”

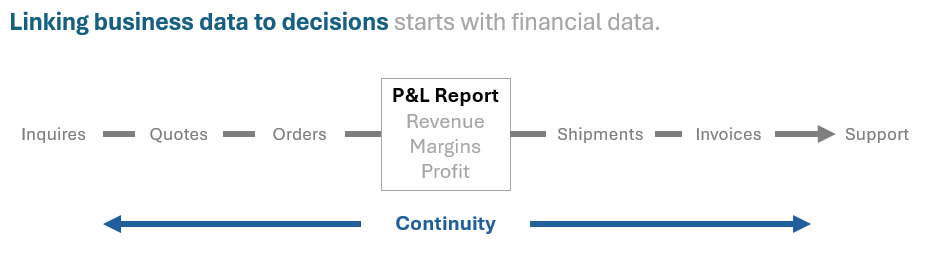

Ken was a system thinker; he understood that every activity in a company relates to all the others. He wasn’t saying that financial data matters more than the rest of your data. Instead, he showed me that the value of any business data depends on keeping it connected to the other parts of the business. All business activities within your company share a common link: they all connect to financial data. Changing a product design increases or decreases the cost of building it. Pricing changes directly impact your company’s revenue. Even an injury to an employee impacts your financial data through future insurance premiums.

In this sense, financial data creates context for every activity — and every decision — in your company. All decisions, in some way, are financial decisions.

Where to Start the Puzzle

Why start with financial data? Because it helps you address some of the most elusive goals of a data strategy. For example:

People trust financial data. You pay taxes based on it, and (if your company is publicly traded) your auditors review it for accuracy and sign off on it. Linking data to the financial statements helps people trust it more easily. You can’t buy trust by simply choosing a different technology.

Financial data creates a sense of direction. The Profit and Loss (P&L) report is the center of your data puzzle. Some business activities are closer to the center than others. Leads and inquiries, for example, start the sales process, but many more steps must occur before they generate revenue. That makes it hard to connect them to financial data. But you can easily connect invoices to financial data. Starting in the middle (like with invoices) makes fitting your data puzzle together much easier.

Start With the Summary

I’m not saying that financial data is the most important data—quite the opposite. Instead, it’s the connecting tissue that underlies the operational decision data. A P&L report summarizes your company’s data but doesn’t include the business details behind the numbers. Detailed operational data tells the story. Why is your profit good or bad, increasing or decreasing? Look to the sales orders, shipments, forecasts, or even sales leads for that news.

If I’ve convinced you that there’s such a thing as a secret decoder ring that connects all this data, you probably realize that this changes your whole direction; it will cause you to see more critical projects and build those solutions differently.

In this new series, I’ll show you how this connection works. For now, take this news to heart: you, too, can become a puzzlemaster.